The social networking, Facebook, have purchased the messaging company WhatsApp in a deal worth $19 Billion in total. WhatsApp is a pretty much free (users pay 99p/year) messaging service with around 450 million monthly active users around the world. The service has become extremely popular due to its almost universal compatibility - it's available on iOS, Android, Blackberry, Symbian (Nokia) and Windows phone.

What Tech IPOs Can We Expect in 2014?

Well, 2013 has certainly been the year for tech IPOs. Facebook shares have jumped 116%, Google, Twitter and Amazon are each up almost 60%, Yahoo climbed over 100% and even AOL shares grew by over 50%, this doesn't even include the likes of LinkedIn and Netflix who also had a bumper year on the stock market. This leaves us thinking that 2014 is likely to be another great year for tech IPOs but which companies can we expect to go public in the next 12 months?

First in the limelight is the Alibaba Group. China's biggest e-commerce company, a mix between Amazon and eBay, on one day alone in November they topped $5.7 billion in sales across the group. Now, the company is looking to go public on the US market and it's expected to be the biggest tech IPO of all time, possibly worth $100 billion.

Next up is Dropbox. The cloud storage company with over 200 million users recently valued itself at around $8 billion and with a healthy business plan that doesn't revolve around the fluctuating advertising market it's probably not far off. Dropbox's biggest issue is competition from the likes of Microsoft who already have business users in the palm of their hands.

The mobile payments company, Square, has recently been talked about with regards to an IPO. It's founder Jack Dorsey, who also co-founded Twitter, has supposedly been in talks with bankers about going public in 2014. The company was recently valued at just over $3 billion and has a more than healthy share in the mobile payments market that it helped revolutionise.

There's a whole host of other possibilities including the likes of Spotify, King, Rovio, and Pinterest but one we're not likely to be seeing is Evernote who's CEO, Phil Libin, says he doesn't expect the '100 year start-up' to IPO before 2015.

Will you be investing in any of the tech companies in 2014 or do have a thought on who might go public? Leave your comments below.

Instagram Direct

At a fairly low key event a few days ago Instagram announced a new service - Instagram Direct. This allows users to send photos and videos to individual users rather than posting to the public - essentially Snapchat but without the 'self-destruct' timer. The update is available to download now on Android and iOS.

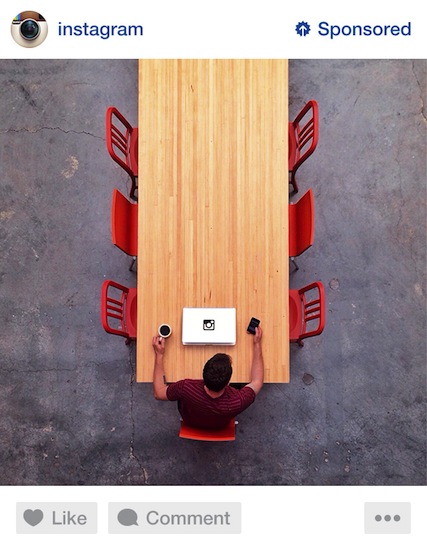

Instagram Gives a Preview of Ads

In a recent blog post Instagram, the photo sharing social network, gave a few more details on it's controversial yet necessary plans to introduce adverts in to user's feeds. They gave a preview of how the adverts will look in your feed and gave assurances that they will be 'creative and engaging' adverts.

Instagram seem to be treading lightly with introducing these adverts and a big 'Sponsored' graphic shows above each advert so you know what it is. They'll also be allowing people to give feedback on the adverts to help ensure they remain relevant to you.

To give even more assurances Instagram are only allowing adverts from selected partners who already have a good standing in the Instagram community and I imagine all the ads will be vetted by the company before going live.

What do you think of adverts appearing in your Instagram feed. Is it a necessary evil or should they try and get revenue from other sources? Leave your comments below.

Twitter IPO

Twitter's latest IPO filings show that it's shares will be offered at between around £10 - £12 ($17 - $20) which values the company at around £6.8billion ($11billion). There's no doubt that this IPO will be watched carefully by those in both the technology and banking industries, especially following Facebook's bad IPO in May 2012.